ESG advisory services are becoming increasingly important as businesses seek to operate with purpose, integrity, and resilience.

The ESG advisory market is expected to grow at a compound annual growth rate of 25% from 2025 to 2032, driven by regulatory requirements, investor interest in ESG-compliant businesses, and a global push toward corporate responsibility.

Growth drivers:

Several global trends are driving the rapid rise in demand for ESG advisory services, including mandatory ESG disclosures, investors driving change, climate change being a top concern, and social impact becoming more important.

Digital transformation is transforming the ESG landscape, with companies adopting digital tools to automate data collection, monitor ESG performance, and visualize results for stakeholders.

Supply chain accountability is becoming essential, and ESG advisory firms help companies assess risks, improve transparency, and partner with responsible vendors.

Regional demand:

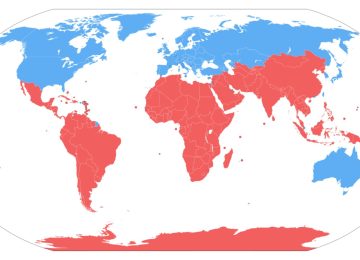

The ESG advisory market is growing globally, with North America experiencing a sharp increase in ESG investment and reporting requirements.

Europe remains the leader in ESG adoption due to comprehensive regulations like the European Union’s Sustainable Finance Disclosure Regulation and the upcoming Corporate Sustainability Reporting Directive.

Asia-Pacific countries are also catching up, with Japan, India, Australia, and South Korea encouraging corporate ESG reporting.

Latin America, the Middle East, and Africa are seeing increased activity as governments push for sustainable development, ethical business practices, and better environmental controls.

ESG advisory services in industry verticals:

Key service areas include health and life sciences, defense and security, energy and utilities, BFSI, and others.

For example, the health and life sciences organizations use ESG services to address ethical research, patient access, and environmental impact from production and waste.

Defense and security companies rely on ESG advisors to ensure governance standards, minimize environmental damage, and uphold ethical sourcing of materials.

Energy and utilities firms invest heavily in ESG advisory to reduce emissions, modernize infrastructure, and increase transparency.

ESG impact:

The global business world is experiencing a significant shift, with companies now being assessed on their ESG impact.

For this, ESG advisory firms provide insights, tools, and guidance needed to measure impact, set goals, and make informed decisions. They help companies navigate complex challenges and turn them into opportunities. The market is segmented into strategy and planning, technical support, and others.

ESG advisory firms help companies understand their ESG risks and opportunities, set realistic goals, create action plans, and align sustainability with long-term business strategy.

Case study:

A mid-sized consulting firm developed a dedicated ESG advisory practice, building an interdisciplinary team of analysts, policy experts, and industry specialists to guide clients through materiality assessments, stakeholder engagement, and framework alignment with global standards.

The firm delivered several high-impact projects, improving investor relations and smoother regulatory submissions.

Challenges and the way forward:

However, the ESG advisory market faces challenges such as data consistency, regulatory complexity, greenwashing concerns, cost and scalability, and internal resistance to change.

Regulatory complexity, including multiple frameworks like GRI, SASB, and TCFD, necessitates companies to understand which guidelines to follow and how to align their reporting.

Greenwashing concerns are increasing, and stakeholders are skeptical of vague ESG claims. Advisors must assist clients in ensuring their sustainability efforts are credible, verifiable, and outcome-driven.

Leadership buy-in and employee training are crucial for effective ESG implementation, and advisory firms often incorporate change management and leadership coaching to ensure successful implementation.

ESG advisory firms are focusing on developing modular service models to cater to clients with limited resources, overcoming challenges of cost and scalability.

All the same, the future of ESG advisory services looks promising, with firms investing in AI-powered ESG tools, blockchain for supply chain transparency and carbon credit tracking, predictive analytics, digital dashboards, and visualization tools.

As demand grows, advisory firms may tailor services for specific industries or focus on areas like climate risk, circular economy, or social impact metrics.