India’s energy sector is at a critical inflection point, with renewables surging ahead while coal-fired generation posts a rare 3% year-on-year decline in 2025.

This is only the second drop in 50 years. Yet coal stubbornly retains its 70% stranglehold in the power mix. This signals a seismic shift toward renewables amid moderated demand and record clean energy additions. It is not a mere statistical blip but a strategic crossroads with profound economic, environmental, and geopolitical implications.

While this can be seen as a landmark victory for climate action, a critical examination reveals a more complex, even precarious, transition fraught with contradictions and unresolved challenges.

Data-driven shifts

India recorded a record year of clean energy growth in 2025, with solar energy leading the way at 35 GW and total renewable capacity rising 23% to over 260 GW. Renewables covered demand peaks like 242 GW, offsetting milder weather’s 36% drag on AC use and broader slowdowns since 2023.

Total electricity rose just 1% to 1,844 TWh, with non-fossil adding 71 TWh (renewables +22% to 270 TWh, hydro +15% to 180 TWh), while lignite fell 9.7%.

| Fuel Source | 2025 Capacity (GW) | 2025 Generation (TWh) | YoY Change |

| Coal | 243 | 1,247 | -3.4% |

| Renewables | 254 | 270 | +22% |

| Large Hydro | 180 | +15% | |

| Total | ~500 | 1,697 | +1% |

Vulnerabilities:

As coal-fired generation plummeted 3-3.4% to 1,247 TWh, the renewables exploded with 44.5-50 GW additions, pushing non-fossil capacity beyond 50% of total installed power, enabling India to be five years ahead of 2030 targets.

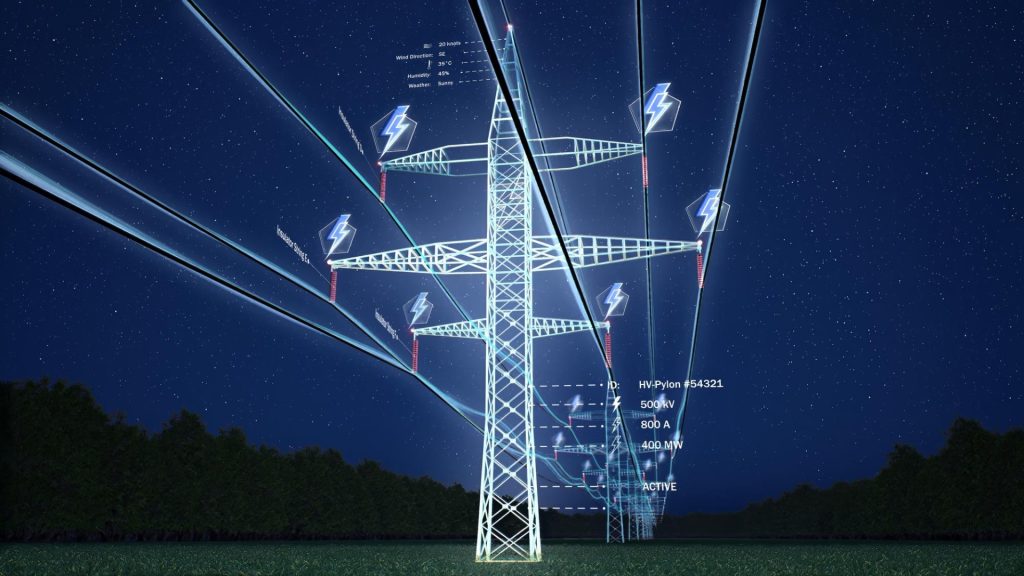

Coal, however, clings to 60 to ~70% of generation dominance, underscoring supply vulnerabilities. This fragile equilibrium leaves corporates exposed to multiple risks. Energy costs fluctuate erratically, supply chains face volatility, and ESG compliance burdens intensify under SEBI BRSR mandates.

Thermal assets risk steep underutilization amid significant GW of new RE capacity. The majority of the thermal plants are running at 55% capacity, the prescribed threshold to run a unit.

On the other hand, overreliance on intermittent renewables threatens grid stability during peak demand loads. With storage deficits amplifying blackout risks, it is also eroding investor confidence in energy-intensive sectors like manufacturing and steel.

India’s grid, historically designed for steady coal baseload, is now grappling with the variability of solar and wind. While battery storage is in its infancy, the real-time management of this shift falls to coal plants. This is increasingly forcing them to ramp up and down to balance the grid, which makes them less efficient, more polluting per unit of power, and less profitable. Potentially creating a vicious cycle of poor maintenance and operational readiness precisely when they are needed as a flexible backup.

However, coal imports dipped 2.2% to 160 Mt, but forex strains persist at 20-25% oil/gas reliance. This inflated costs in energy-hungry steel and manufacturing amid PM2.5 pollution crises.

The economy of coal

Coal is not just an energy source in India but a social contract. The sector employs hundreds of thousands and supports entire regional economies in states like Jharkhand, Chhattisgarh, and Odisha. A decline in generation without a comprehensive, just transition plan risks social, economic, and possibly political backlash. The current data masks this human dimension. A managed decline requires massive investment in retraining and alternative economic development in coal regions. A challenge that has to be addressed with focus and at the required scale.

The demand conundrum:

Though India stands tall with over 500 GW of total installed capacity, the electricity per-capita electricity consumption is still only a third of the global average. Its development aspirations guarantee soaring demand for decades. The government’s Power for All mission has been a success, but it has also locked in a higher baseline demand. In this context, coal is still framed as the bedrock of energy security, a domestic resource that reduces vulnerability to global price shocks in oil and gas.

Business Imperatives

To derisk coal exposure, the corporates must accelerate hybrid strategies blending flexible thermal with battery storage and green hydrogen by 2028.

The power generators should integrate the hybrid models and supply firm dispatchable power with RE to counter volatility. Companies should safeguard operations in a market where energy costs could surge 15-20%. Policy-level interventions should ensure localization of supply chains and embed ESG metrics for investor appeal. Delaying risks 15-20% energy cost spikes if demand rebounds 5-7% annually.

True self-reliance demands ruthless grid modernization and manufacturing localization. The y-o-y decline in thermal power generation is a symbolic milestone, but it is premature to declare it the definitive turning point.

The transition is being driven less by a deliberate, policy-led phasing out of coal and more by the sheer economic force of cheaper renewables meeting incremental demand. This passive transition is risky. It leaves the grid vulnerable, the coal sector in a volatile financial state, and the communities in limbo.