The news out of Britain in this final week of 2025— Britain pushed ahead with green power. Its grid can’t handle it—it is the ultimate cautionary tale for the global energy transition. In late 2025, the UK celebrated a historic milestone: wind and solar delivered over 50% of the nation’s electricity. But the celebration was short-lived. The physical transmission lines are in “cardiac arrest.”

Because the UK’s grid was built for the 1960s—designed for centralized coal plants—it cannot handle the massive surges from northern wind farms. In 2025 alone, the UK paid a staggering $2.3 billion (£1.8 billion) in constraint payments to green generators. Essentially, the government is paying wind farms to shut down because the industrial pipes of the grid are too narrow to carry the harvest. We are effectively subsidizing waste because our infrastructure cannot keep pace with our innovation.

The global picture: a trillion-dollar queue

Britain is not an outlier; it is a preview of a systemic global crisis in power delivery. As we enter 2026, the global “interconnection queue”—the line of green projects waiting for a plug—has swelled to nearly 3,000 GW.

To put that in perspective, while global renewable generation is booming, the infrastructure to support it has stalled. The IEA reports a 3,000 GW backlog of projects waiting for grid connection—a volume of power equivalent to the combined national grids of the United States, the EU, and India. While China has surged ahead to a total capacity of nearly 3,800 GW, the rest of the world remains trapped in a ‘technical limbo’ where trillions in capital are ready to deploy, but the physical wires simply do not exist to carry the load. This is not just a delay; it is a global “technical limbo” where trillions in capital are waiting for a wire.

In the United States, solar projects now face wait times of five to eight years. In the Netherlands, the grid reached such saturation by late 2025 that the government began denying connections for new schools and housing developments. The “green discount” promised to consumers is being eaten alive by the cost of grid congestion.

India’s 500 GW milestone: success vs. stress

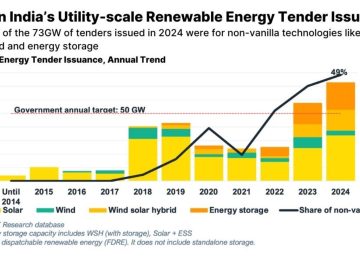

India has just reached a historic milestone. As of November 30, 2025, the country’s total installed capacity officially hit 509.64 GW, with non-fossil fuel sources accounting for 51.55% (262.74 GW). We have hit our COP26 50% capacity goal five years early—a feat unmatched by any other major economy.

However, the UK Wall is looming. India added a record 44.51 GW of renewable energy capacity in the first eight months of FY26 alone (April–November 2025)—nearly double the same period last year. But the transmission lines responsible for carrying that electricity are lagging.

The stranded asset problem:

An estimated 60 GW of renewable capacity is currently stranded due to inadequate transmission.

The Rajasthan Crisis: In Rajasthan, nearly 4.3 GW of solar power faced daytime curtailment (forced shut-offs) in late 2025 because the grid could not absorb it. This has led to industry losses exceeding ₹250 crore, putting projects worth ₹20,000 crore at financial risk.

The 2026 readiness roadmap: A state-by-state reality check

As India prepares for the 2026–27 fiscal year, the Central Electricity Authority (CEA) has drafted a ₹2.44 lakh crore ($30 billion) roadmap to add 51,000 km of new transmission lines. But readiness varies wildly:

The Frontrunners (Gujarat & Karnataka): These states remain the gold standard. Gujarat’s Khavda-Nagpur HVDC link is a model for long-distance evacuation. Karnataka has successfully balanced its high wind and solar mix through better intra-state transmission (InSTS) planning.

The Wind Leaders (Tamil Nadu & Maharashtra): Tamil Nadu continues to lead in wind, but its challenge in 2026 is liquidating regulatory assets to fund grid upgrades. Maharashtra is catching up, but industrial demand is growing faster than the green energy corridors can be built.

The Bottleneck Zone (Rajasthan): Despite having the highest solar capacity (43 GW), it is the hotspot for stranded assets. Ecological hurdles, like the Great Indian Bustard power-line case, have left nearly 8 GW of ISTS-connected projects in limbo.

The Slow Tier: Uttar Pradesh, Bihar, and West Bengal continue to lag in power ecosystem readiness, risking their ability to attract green industrial investment.

Our Take: The ESG Pivot

The UK’s winter of grid discontent proves that a green revolution without a grid evolution is simply an expensive way to fail. For investors, the “low-hanging fruit” of installing panels is over. In 2026, the real value lies in grid resilience.

The data from the Indian Energy Exchange (IEX) in December 2025 reflects this stress. While trade volumes are up 18%, Renewable Energy Certificates (RECs) are clearing at a floor-hugging ₹360–₹370, signaling a market that is flooded with “intent” but restricted by physical “delivery.”

In 2026, the most important ESG metric will no longer be how much green energy a company buys—it will be how much of it the grid can actually deliver.