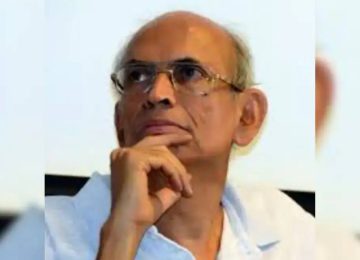

S. Karthikeyan, Deputy Executive Director of the CII Indian Green Building Council, explores the key drivers of green finance amid India’s ongoing green transition.

India is at a pivotal moment in its development trajectory. As the country accelerates economic growth, it simultaneously faces environmental challenges. With commitments under the Paris Agreement and a national pledge to achieve Net Zero emissions by 2070, the transition to a low-carbon, climate-resilient economy is an imperative. Financing this transition requires innovative approaches and sustained investments. Green financing has emerged as an enabler in this context, directing capital toward environmentally sustainable projects that align with national climate goals.

Green finance refers to financial instruments and mechanisms that support initiatives with positive environmental outcomes. These include investments in renewable energy, energy efficiency, sustainable transportation, water conservation, climate-resilient infrastructure, and green buildings. In the Indian context, where infrastructure development is growing rapidly, green finance offers the dual benefit of promoting economic progress while safeguarding natural resources. There are multiple green financing options available including Green Bonds, Green Loans, ESCO financing, Sustainability linked loans, Multilateral & Bilateral financing, Grants and subsidies etc. However, project proponents have utilized Green Bonds and Green loans extensively compared to other options due to their accessibility and ease of availing the same.

Over the past few years, India has made significant strides in shaping a conducive ecosystem for green finance. A key milestone was the issuance of Sovereign Green Bonds by the Government of India in 2023. The initial offering, valued at ₹16,000 crore, marked a strategic move to raise capital specifically for green infrastructure projects. These funds are allocated to sectors such as renewable energy, clean transportation, sustainable water management, and green building initiatives. The success of the sovereign issuance has created a strong foundation for expanding the green bond market in India.

The private sector has also begun to adopt green financing. Indian corporates, particularly in infrastructure and energy, have issued green bonds to fund their sustainability initiatives. Public and private banks are exploring green loan products, and several institutions are actively developing frameworks to integrate environmental, social, and governance (ESG) criteria into lending practices. Regulatory bodies, including the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), have played a supportive role by promoting disclosures and transparency in green investments, thereby increasing investor confidence.

Among the sectors positioned to benefit the most from green finance, green buildings stand out as a high-impact area. Buildings contribute approximately 40% of global energy consumption and nearly one-third of greenhouse gas emissions. With urbanization intensifying across Indian cities, the potential for improving environmental performance in the built environment is immense. The Indian Green Building Council (IGBC) has been instrumental in advancing green building practices in the country. Through its comprehensive suite of rating systems and sector-specific guidelines, IGBC has catalyzed the green transformation of more than 14 billion square feet of registered green building footprint.

Green finance plays a vital role in scaling up green buildings by addressing one of the key barriers, initial capital costs. IGBC-rated green buildings are designed to be resource-efficient, with reductions of 20–30% in energy and water consumption. These operational savings improve the long-term financial viability of such projects and make them attractive to both investors and occupants. As per International Finance Corporation (IFC), the potential for green financing in building sector in India by 2030 is about USD 1.4 Trillion. The residential and commercial building sector contributes more than 85% of the total potential.

Financial institutions are beginning to recognize this value. Some banks have introduced green home loan schemes with preferential interest rates for IGBC-certified buildings. Additionally, developers of green projects gain access to sustainability-linked finance options that reward measurable environmental performance.

Despite these positive developments, the growth of green finance in India faces several challenges. One of the primary issues is the lack of awareness and technical capacity among stakeholders, including developers, and financial institutions, to structure and evaluate green investments. The absence of a standardized green taxonomy tailored to India’s unique needs also limits the effectiveness of green finance. Furthermore, while green bonds and loans are gaining traction, they still represent a small fraction of the overall capital market.

To bridge these gaps, there is a pressing need for greater coordination between policymakers, financial institutions, and industry bodies. The Department of Economic Affairs under the Ministry of Finance released the Draft Framework of India’s Climate Finance Taxonomy in 2025. This climate taxonomy aims to provide a standardized classification for economic activities based on their environmental impact. The building sector is covered under the framework and once the taxonomy is fully launched and operationalized, it is expected to enable investors and financial institutions to channelize climate capital into Green and low carbon building projects.

Capacity-building programs aimed at bankers, developers, and government officials can help integrate sustainability into decision-making processes. Public-private partnerships can also accelerate investment flows into green infrastructure, especially in urban transport, affordable housing, and industrial zones.

The Indian Green Building Council is committed to enabling this transition. IGBC continues to engage with banks, investors, and policymakers to advocate for financial products that support green buildings. By offering certification, technical support, and market linkages, IGBC helps reduce the perceived risks of green investments and builds investor confidence.

Green financing is a strategic lever to unlock India’s sustainable future. As the country moves toward its Net Zero targets, aligning financial flows with environmental priorities will be essential. With a collaborative, well-regulated, and innovation-driven approach, India can lead the way in demonstrating how green finance can drive inclusive, climate-resilient growth for generations to come.